Residential real estate, specifically rental property investing and management, is an industry that has provided ancillary income and financial freedom to hundreds of thousands of Americans and piqued the interest of many more. With COVID-19 on the minds of everyone, right now, it’s safe to say that the pandemic's impact on real estate is also on the minds of many.

Every day we are given, what seems like, new and different information regarding the novel COVID-19 pandemic and how we are to go about our lives during this time. It’s difficult to know which information is correct and which isn’t. Most of us are taking it a day at a time as we receive new information and we tend to agree and latch on to the information that resonates with us the most.

The same can be true of how this is affecting the real estate market so it’s important to speak with and hear from those who have been in the industry for a long time with experience in several different areas of the industry. Those individuals are the ones who, typically, have the most reliable information and knowledge to share.

That’s why we went directly to NRS’s own owner and CEO with the questions that are on the minds of real estate investors and property owners alike. In the following interview, we ask real estate expert, Steven Gouletas, about the current real estate climate including changing lending restrictions, sales inventory, evictions, inflation, and more. Please enjoy and contact us today for any of your property management or rental property investing needs.

Thigpen: Hello, everybody! My name is Kat Thigpen with NRS Rental Property Management, Leasing, and Investing and we're here today to talk about whether or not, right now, is a good time to invest in real estate. And with us today we have our very own owner and CEO of NRS, Steven Gouletas. Thanks for being with us today, Steven.

Gouletas: Glad to be here. Thank you, Kat.

Thigpen: Of course! So, before we get started, I wanted to see if you wouldn't mind sharing a bit about your background and your experience with us?

Gouletas: Sure, be glad to. I've got 30 years in the residential real estate industry. The last 20 years, I’ve been significantly involved in the multifamily part of the industry and the last decade, the single-family part in addition to the multifamily part. I'm designated by the National Association of Residential Property Managers otherwise known as NARPM with their CRM or Certified Residential Manager. Also, I have a CAM designation, Certified Apartment Manager, and I taught that course, the finance, budgeting and value-add part of that course for the National Apartment Association for three years. I've got an MBA and a JD from Notre Dame.

Thigpen: Awesome. I hear you play some pretty mean disc golf too.

Gouletas: I love disc golf.

Thigpen: Awesome. World championship, I heard?

Gouletas: Yeah, last two years.

Thigpen: Congratulations. That's amazing. Well, thank you so much for sharing that with our crowd so we can show them what we know! So, let's get started. So, I know there have been a lot of changes in the lending landscape because of COVID-19 and the pandemic that has reached the world. What have you been seeing as far as lender restrictions, right now, as it relates to purchasing investment properties?

Gouletas: Yeah, that's a good question, Kat. And, you know, the minimum credit scores have gone up substantially, as much as 750 which is really, really high and they're looking for typically 25% down. The percent down isn't so high, especially for an investment loan, but the credit score is significantly higher than it has been in the past and it will certainly vary from lender to lender so I would advise you to search out multiple lenders if you're not finding something that suits your needs.

Thigpen: Absolutely, yeah it sounds like that's quite the obstacle. Are there any solutions out there to overcome some of these restrictions that you know of?

Gouletas: Yeah, it certainly depends by lender, again, but always it helps to put more money down then the lenders feel more secure. Their loan to value is much safer. If you can get a guarantor who maybe has a higher credit score, that can be very helpful and finally, there are other types of loans that may be higher cost that are more flexible in terms of the underwriting that they do on the clients.

Thigpen: Right. Yeah, it sounds like cash is king right now, for the most part.

Gouletas: Absolutely, absolutely.

Thigpen: How about sales inventory… are we seeing any changes in what's on the market currently vs. before this pandemic started?

Gouletas: Absolutely. In terms of the number of properties going on the market that's been decreased and, as you can imagine with the lockdown, there haven't been a lot of showings. And so, it was already slower this year than last year and this is making it substantially slower. We haven't gotten Marches numbers yet but I expect them to be, to have a significant reduction in terms of new listings coming on the market. There'll be a fair number of closings because there are closings from before March in terms of sales that occurred. I have one myself occurring today, in fact, on a fix and flip and that property was sold, in terms of going to contract, about two months ago. So, again, we're seeing that pipeline get cleaned out and I think it'll be even slower this month, May.

Thigpen: Wow, sounds like a lot of changes, a lot of turmoil out there but are there a lot of buyers on the market currently, you think?

Gouletas: You know, I think the buyers are staying inside. There aren't a lot. Also, as you may guess we don’t have the normal things going on. People aren't moving for jobs right now so they're not putting their homes up for sale right now. Everything's kind of stalled in place so that's slowing the market down.

Thigpen: That makes sense. Wow. Well, let's say someone did find a property and they were able to close on it. They paid cash or whatever they did or they found some leverage, how is NRS overcoming the shelter in place order and social distancing as it pertains to showings and finding new tenants?

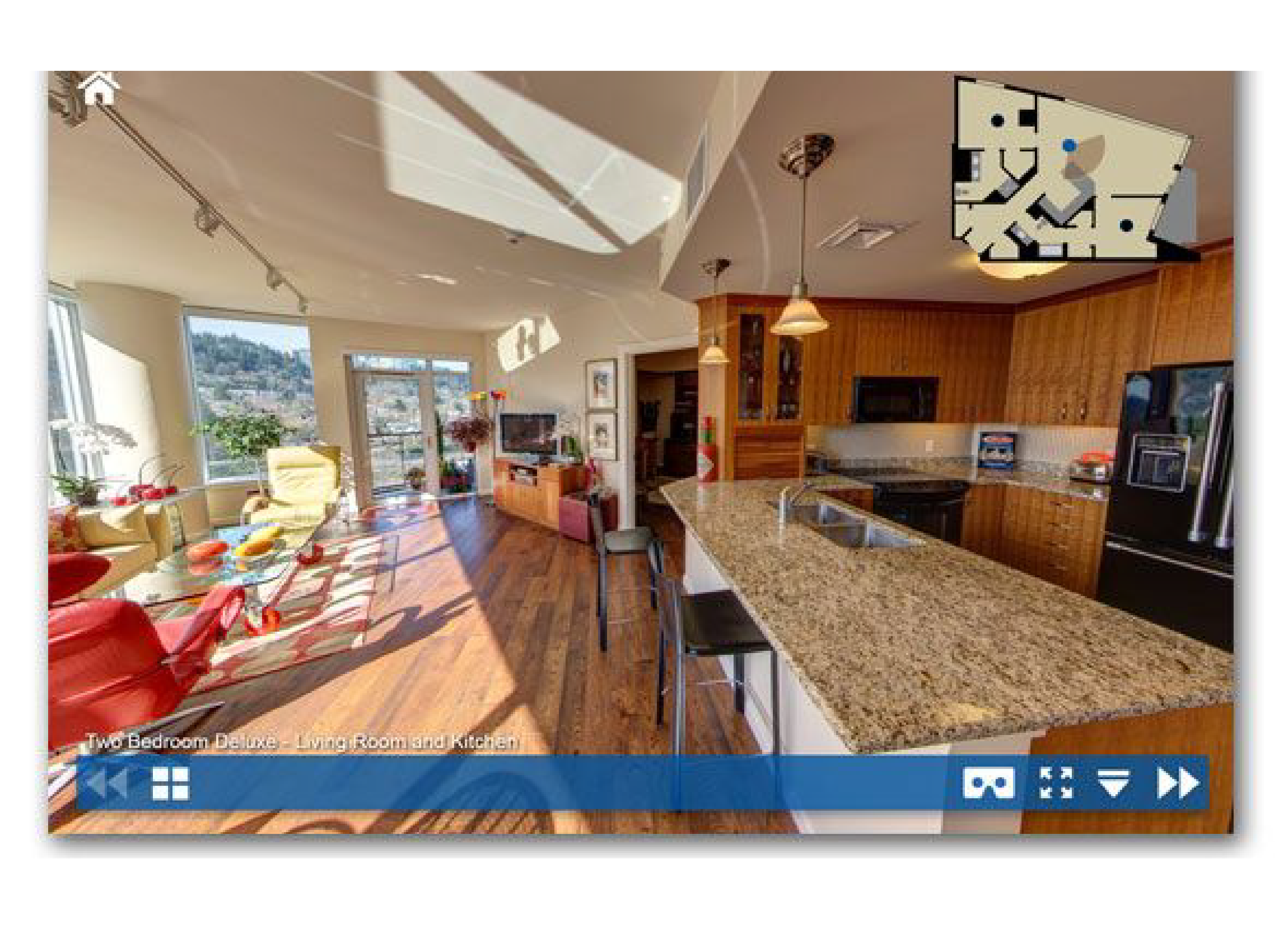

Gouletas: As it relates to finding new tenants, what NRS is doing is we will not only take pictures of the property, we're taking videos of the properties so that someone can shop online and rent online so that they don't have to even go into the property. They can shop from the comfort of their home via our website and our links to our website so we make it really easy for them. If that isn't adequate we're even willing to go and walk through the property with our camera on so that they can see anything in greater detail that they want to see.

Thigpen: Right. That's great so you've found some success in this so far?

Gouletas: Yes, people are loving it. We're getting a lot of people, for the first time, for all practical purposes, that are buying, if you will, without walking into the property.

Thigpen: Right. Would you say those prospects are more serious now than they were before?

Gouletas: Yeah, we're not getting as much traffic but the traffic that we do get is far more serious and they're not shopping as much. If they see what they like because they previewed it online before they come to us, most of the time, it's a relatively short sales cycle and it's just working fantastic, to tell you the truth.

Thigpen: Good. Wonderful. Now, kind of a subject that's probably on a lot of people's minds, are tenants finding it difficult to pay rent right now in light of this pandemic and a lot of unemployment out there?

Gouletas: Yeah, and it's interesting on a national basis it really varies greatly by area and it also varies by socioeconomic income. I've got a property in Huntsville which is very defense based and it's like nothing ever happened there. We also manage a lot of properties in Florida in the Orlando area and things have slowed down there a lot because it's very service based on the amusement parks: Disney, Universal Studios, etc., and people aren't flying there. Most of the people that go there fly there. They don't travel locally to go to Disney or Universal and so Disney even talked about maybe opening up the beginning of next year and so that could be slow for a long time. And Chicago is somewhere in the middle. From a socio-economic impact we manage in Chicago properties on the South Side, West Side, North Side and downtown Chicago. The properties on the north side and downtown, those renters are finding easier to pay. They were able to work from home, they have more reserves where a lot of the people on the South Side and the West Side have hourly jobs. A number of them working in restaurants or bars or other service type of jobs where the jobs just don't exist right now and so they're finding it very difficult. We've tried to give them references of where they could go to get some financial support. We certainly talked to the owners and let them know that this is a challenging time and as soon as they get a job they can start paying again and we try to work out payment programs but my heart goes out to them because they live paycheck to paycheck so the little bit that the government is doing in terms of sending out checks to them, providing unemployment, which is fantastic, it's all desperately needed and much appreciated.

Thigpen: Right. Absolutely, it's definitely a trying time but it sounds like you're doing a lot of creative solutions, creative problem-solving to help these guys as best as you can. That's wonderful. What's going on with evictions and late fees right now? Is that going through? What are we doing?

Gouletas: Right. So, in Chicago, like a lot of places they're not allowing tenants to be evicted while they're in shutdown. They feel that if they can't get a job, it's not right to kick them out of their home because they need somewhere to live and as soon as they get a job, they'll be able to pay again. It, obviously, can affect your credit score if you're not paying your rent but I understand for those people that don't have a job or had one and got furloughed or terminated, they're doing the best they can and we need, as a society, to be sensitive to that.

Thigpen: Definitely. Well, there are certainly several obstacles that a lot of investors are facing right now. Off the top of your head are there any other potential obstacles investors might be facing right now that we haven't discussed yet?

Gouletas: Yeah, and generally everything's a little slower. Closings don't happen quite as quickly. You're closing by sending documents in as opposed to meeting at the closing table in terms of the attorneys and the title company. Your inspectors might be a little slower to get things done. You’re trying to find a contractor to finish something off. They may not be as quick to get things done, as well, so everything's just a little bit slower but it is moving forward. Things are happening so you make the best of it.

Thigpen: Absolutely. Well, it sounds like there is a little bit of light in that darkness then. Can you tell us why it might be a good time to invest for some investors? Any other pros right now?

Gouletas: Yeah, there’s always a way to make lemonade out of lemons. In the stock market they say, “sell high, buy low,” and the stock market reacts really quickly to changes in the environment. The real estate market on the other hand is very slow to react. It's a bunch of individual sellers and individual buyers and until those individual sellers feel the pain of not being able to sell their home and are stretched in terms of their resources, if they're paying two mortgages, etc., or really needing to move for that job, they're gonna try and get as much for their property as they can and rightfully so. I think that what we're gonna see is 30, 60 days from now, prices will start coming down a little faster than they probably did last month or this month. Then it all depends on how long this virus goes on for. We really need a vaccine or cure or really good cheap accurate testing to get a hold of this, and get the economy back and up and running. As of right now, we've got testing starting to come out but it isn't a hundred percent accurate either, so I think things are going to be slow for a while and especially in those higher service areas like Orlando it could be slow for much more than 30, 60, 90 days. So, I think there's going to be a really good opportunity for investors to buy some investment properties at some really good prices. There may be more foreclosures as well and that can always be a great place to buy a good investment property and, oftentimes, those are properties that need to be rehabbed and so you can use the time that you, otherwise might have found it difficult to find tenants, to fix up the property and you're not really losing out on any income because it was going to be hard to come by anyway, and, hopefully, by the time you're done fixing up the property, the rental situation will be better and you'll be able to have a nice income-producing property to help build your portfolio in your retirement goals.

Thigpen: Definitely. So, it sounds like what you're saying, and correct me if I'm wrong, now is a good time to possibly start looking but not necessarily the time to purchase just yet?

Gouletas: Yeah, and I think you want to be in the market now looking, that's an excellent point because you want to see where the prices are, how many properties are out there, how many days on the market those properties are out there for. That'll give you some kind of indication of how motivated the seller might be and as you can see the changes in the marketplace, you're gonna feel more confident about buying at the right time. And the other thing I'd say is if you find a property where the numbers work for what your goals are, there's nothing wrong with buying something today instead of waiting a month or two to see if it does go down. Because if the numbers work, the numbers work and ideally you would buy a second or third property if you've got the funds available to do that. It's kind of like in the stock market, you can't pick the bottom, you can't pick the top, you can't pick the bottom so you kind of, income average. Pick up as many good deals, maybe not the best, but if the numbers work, the numbers work and you're gonna be well rewarded in the long run for any property where the numbers work in your favor.

“Real estate is one of the best hedges against inflation.”

Thigpen: Absolutely. Great. What other final thoughts would you like to share with our audience today about investing in real estate as far as that investment property goes today?

Gouletas: You know, one of the great things about investing in real estate now, especially with all the funding that the government is putting in to support the economy, is there's a really good chance we'll have inflation and real estate is one of the best hedges against inflation.

Thigpen: Absolutely!

“…make retirement something that you can thrive in instead of just survive in.”

Gouletas: Because you're leveraging your money. You're going to be able to get more and more for rent but your mortgage is fixed. You've fixed the price that you paid for the property and so the property can appreciate, your rents can appreciate, and most investors, investment advisors, will tell you, you want a minimum of 10 up to 25 percent of your financial investments in real estate. They give you very good cash flow and, if you're able to pay it off in 20 or 25 years with paying down a little bit more on the mortgage, possibly by paying two times a month instead of once a month, it can be a perfect retirement income, ancillary source for you. So, if you have three properties bringing in three thousand a month or five properties bringing five thousand a month after the mortgage is paid and all your paying is taxes, you can easily be picking up a nice retirement income in addition to your Social Security to make retirement something that you can thrive in instead of just survive in.

Thigpen: Absolutely. That's a really good point. Protection against inflation is huge because we're just printing money like it's going out of style right now and that's definitely bound to come in the future.

Gouletas: It's unprecedented how much money is being printed now by the government. Now more than any time in the history of the government.

Thigpen: Unprecedented times indeed.

Gouletas: Yes, so it's a wonderful time to invest, not only because you can buy properties at a lower price, but because it's a great hedge against inflation.

Thigpen: That's a great, great point. I'm glad you brought that up. Any other points that you would like to mention?

Gouletas: I think that'll cover it. You know, it takes a little bit of courage to buy now because things are slow and you don't know how long they're gonna be slow but it can also be the best time to buy. And, like the stock industry says, you want to buy when you're scared. You want to sell when everybody else is buying and everybody else is fat and happy. Everybody was really fat and happy four months ago and investors were still buying like crazy. Right now is really the time to be looking and buying in the next 30 to 180 days. It's gonna be our best time.

“Right now is really the time to be looking and buying in the next 30 to 180 days.”

Thigpen: Wonderful. Well, hopefully we can get some good deals out there and see if we can make some of our investors some money over the long run if they fix and hold.

Gouletas: Yeah, I know a lot of investors have been waiting for this because it’s been a long time since we had our last turn around. It was 2008 and it's 2020 now so it's 12 years since our last recession. Usually, it's like every seven years. People have been predicting this for years and years and years, for at least the last five years and now it comes because of a virus.

Thigpen: Oh my goodness. Well thanks…

Gouletas: Other than Bill Gates who predicted it, right?

Thigpen: Right, but he knows all.

Gouletas: He is all-knowing. He's a bright guy.

Thigpen: He sure is. Well, thank you so much for sharing with us and joining us today. If anybody out there has any other questions or would like some more information, please visit us at www.NRSrentals.com. Contact us and find out more about our property management or our investing solutions and we thank you so much for joining us. We hope you're all well and safe and take care!