Real estate calculations will make or break your real estate deal. As with any large purchase, it’s important you run the numbers before you purchase the property to see if it’s a good deal or not. Seems like common sense, right? Even if you are running the numbers on every single property, there may be some factors you hadn’t considered before such as reinvestment rate or how many years to hang on to the property to get your highest return.

Kat Thigpen interviewed real estate data scientist and real estate expert, Louis Gouletas, on some real estate investment calculations that most investors are currently using and they also cover some calculations, typically used in the commercial real estate space, that you may not be familiar with yet. Louis helps us break down the pros and cons of each of these calculations and explains in great detail how each one works and the why behind each calculation and when you should use it.

Interested in starting your real estate investing journey?

Kat Thigpen:

“My name is Kat Thigpen with NRS Rental Property: Management, Leasing and Investing and I'm here today with Louis Gouletas. He is our managing partner and Chief Technology Officer of NRS Rental Property. He is also a Certified Property Manager with the Institute of Real Estate Management, also known as IREM. He's an Argus certified commercial real estate financial analyst, and a Northwestern and the University of Chicago trained real estate data scientist. Thank you so much for being with us today, Louis.

Louis Gouletas:

Hi Kat. Excited to be here.

Kat Thigpen:

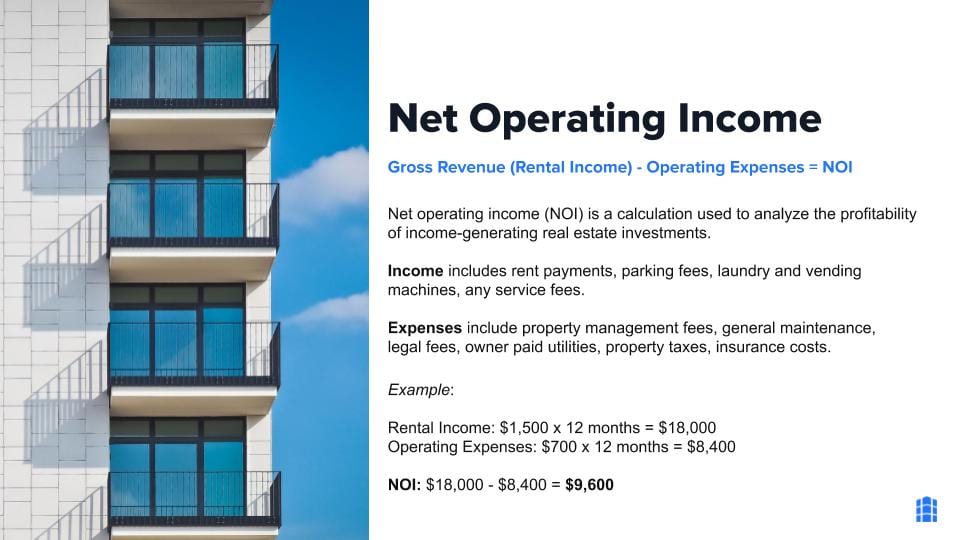

Good to see you. So today you and I are going to discuss some real estate calculations for investors, and we couldn't have found a better person to do this with than you so I'm so glad you're here with us today. So let's get started. The first one we're going to talk about is net operating income. For those who don't know, that is a basic calculation of gross revenue or your rental income, whatever you're generating income wise for your property minus your operating expenses. And that is your NOI. So it's a calculation used to analyze the profitability of income generating real estate investments and income can include things like parking fees, the rent payments, laundry, and vending machines. Any other service fees that you're charging tenants. Expenses can include property management fees, your general maintenance, legal fees, owner, paid utilities, property taxes, and insurance costs. Now something to keep in mind, this does not include mortgage payments so this will not be in this example, but just a basic example for us to view right here is rental income of $1500 times 12 months is $18,000. Your operating expenses, you know, $700 a month at $8,400 for the year. So your NOI comes out to $9,600. Now, Louie, do you mind going into this a little bit further for us?

Louis Gouletas:

Yeah. So the whole idea behind real estate investing is that we're purchasing a set of ongoing cash flows. In fact, it's what the financial world gravitates around when we're trying to add value, say to potential future earnings. When you buy a stock, the fundamental idea is that you are buying the right to those future earnings of the company as a price per earning share, which is a popular metric that you might hear in the wall street journal or something like that. Now today with the COVID pandemic stocks have an all time price per earnings share value. In other words, we're paying a lot for that stock to get the earnings that they're having. Why because well, earnings are down across the board for many of the companies that are out there today. And we do see a little bit of this at the moment in commercial real estate, especially multifamily as certain specific areas have been impacted more than others, such as Orlando, where we have properties while Disney World is closed, right now, so many of our renters are having a bit more of a difficult time than say in Huntsville, Alabama, where they continue to grow both in rent increases and in valuations because it's so military dependent and that is a necessity so they have continued with that work. So what we're looking at here is the cashflow is mostly from the rent, especially if you're purchasing a single family home as a rental investment or a small two flat or three flat, you are going to mostly see all of your operating income come from that rent. If you are a commercial property, you might have mixed use so it could be some that's generated from the commercial tenants that you have. Some could be from advertising on a billboard. There could be additional revenue streams that are coming in. And so of course, we then need to look at the expenses that are happening.

Louis Gouletas:

And this is a very simple calculation to help us understand what those cash flows might look like and can get very complicated if we want it to, from everything from reserves that we might be putting into place or different things that we're doing with taxes, but at the core basis, if I just have a rental home or I'm using some rule of thumb, I might just take the rent times 12 months and say, you know what, 50% of this is generally going to expenses and I can very quickly get an NOI that I can use for many of these other calculations we're going to see build upon these cash flows. And how do we generally in real estate calculate that is going to be our NOI, our net operating income. So we'll see that as we go through some of these others. One other thing I want to bring up is the idea of operational expenses versus capital expenditures.

Louis Gouletas:

So generally when we're talking with NOI, we're going to be talking about our operational our day to day type of expenses that we see annually opposed to our cap X expenses might be what we put into the property to begin with, to fix it up, to get higher rents, to have lower maintenance costs moving on. There is a little bit of sometimes some accounting specific standards that come into place with reserve holding and some different, more advanced things. But generally the capital improvements that you're doing are separated from your ongoing operating expenses that are gonna affect that annual revenue to get us to that NOI year per year. The other thing to consider is that the NOI is going to be different across different property types. That's not the same for all. So I already mentioned that single family homes, generally you're gonna see a higher expensive ratio, maybe 50%.

Louis Gouletas:

They also have a greater variance. So if you don't invest in the property, if you don't do the fix up that you need, if you're not improving capital improvements to get higher rents and keep the NOI, hopefully growing year to year, there's going to be a greater impact on your expense ratio. How much of the expenses or less revenue you're getting by not making those improvements. In multifamily, you're going to probably have lower somewhere between 39% to say 43%. And it depends what type of class you have or mix use of the property, A class, B class, C class, something like that, and is going to vary, of course, from region to region. But it's a ground basis on which we can start to look at the property and the cash flows that is producing for the first year that we own it. And hopefully every year after that, we're going to see it throughout the calculations used today.

Kat Thigpen:

Great. Wow. That's a lot of really good information about NOI. Now, as far as benefits or flaws, go on this, I mean, this wouldn't be a calculation you would use holistically, correct?

Louis Gouletas:

Right. So it just establishes that cash flow that we're going to use for the first year of hopefully many years in several other calculations, such as the cash on cash return that we're going to see coming up next.

Kat Thigpen:

All right. Well, let's go there now. And any other thoughts on NOI before we move forward to the next one?

Louis Gouletas:

I think we'll be seeing quite a bit of it with these next calculations.

Kat Thigpen:

I agree. Okay. So cash on cash return is a little more detailed than the NOI, and it is basically the difference between your annual pre-tax cash flow divided by your cash invested. So your pre tax cash flow includes things like your gross scheduled rent and your other income, and you combine those and then subtract the vacancy, any operating expenses and your annual mortgage payments. So as we saw with NOI, it did not include the mortgage payment. So this calculation does actually incorporate that. And just for the pure definition, cash on cash return measures the potential first year cash flow the investor could make from the property in relation to the amount of cash invested. So, depending on your financing and your annual debt service. And just a basic example to give before you jump in Louie, cashflow, so again, NOI minus debt service is $10,000. Your total cash invested let's say was $0,000. Your return would be the $10,000 divided by the $40,000, which gives you a 25% cash on cash return. Does that sound right so far, Louie?

Louis Gouletas:

Yeah. So this is a very popular, streamlined back of the envelope type calculation that's used mostly to compare properties quickly, especially if you're just talking on a pure cash basis. So you can do this without considering a loan or a mortgage. And then this becomes really quick. It's what do I think the cashflow is going to be? The NOI? So there's the first metric that we're using that uses NOI versus how much money did I put down? So a very quick calculation could be, I think that I'm going to make $20,000 off of the rent for this property. I might take the total rents times, 12 months, something like that, and I think it's going to be a 50% expense ratio. So half of $20,000 would be that $10,000. And then the amount of money it's going to take for me to get this property is going to be $40,000 hard cash out of my pocket.

Louis Gouletas:

That seems a little bit low, but it's a nice, easy numbers to start off with, and then we're going to see a cash on cash of the 25% here. So then I can go to some other property that wants $80,000 down out of my pocket. I can start to look at a cash on cash return. In other words, I give you $40,000 and in the first year I get $10,000 back. So it's the cash on cash, the cash out versus the cash in just for that first year. And that's already one of the problems that we're going to see with this is, it is the NOI just for the first year. So what happens if I hold this for 10 years? What does that look like? Well, unfortunately this metric falls short on being able to calculate in what might happen with my cashflows in subsequential years that come up here. So the other issue is there's less of potentially a property valuation consideration, especially when I start to look at the mortgage and we're not necessarily looking directly at some marketing pricing that we would market pricing that we would see in cap rates, which I think we're going to talk about next.

Kat Thigpen:

Yes, we are. So real quick on cash and cash return. So what is a situation you might actually use this calculation since it's so limited?

Louis Gouletas:

This is often for someone that has a bunch of cash that is looking to very quickly consider what do I do with it? Am I going to put this into the stock market? Am I going to put this into some bonds or a CD or a property? It's not exactly apples to apples type of comparisons, which is going to be a theme we see throughout this is how do I compare a real estate investment versus a stock or bond or more traditional investment? Real estate investments are called alternative investments. So it can help compare a little bit with that of if I go and do a CD and I'm going to get 1% on it and I have to hold it for five years, I can calculate how much return am I going to get versus how much cash I had to give them. So it can be compared a little bit that way.

Louis Gouletas:

Most of the time, it's used very quickly to look at one property versus another. In other words, how much NOI am I getting versus how much cash came out of my pocket to get that NOI, to get that cash back. And in that first year, it's the cash flow, the earnings or the revenue stream that we're buying. Because again, at the end of the day, when we purchase real estate, especially in investment property, we better have rental income coming in one way or another that pay you some type of monthly rent just as if it was, you know, the salon and the retail or the hotel that was on a master lease or something like that, right. We're buying the cash flows that come along with the ownership, but we're also buying the headaches, the issues, the problems, otherwise known as the expenses of the properties and are we at a positive cash flow, which is why it's important to understand the NOI to be able to calculate cause if it's a negative, you've definitely bought yourself a headache and possibly liability opposed to an asset.

Kat Thigpen:

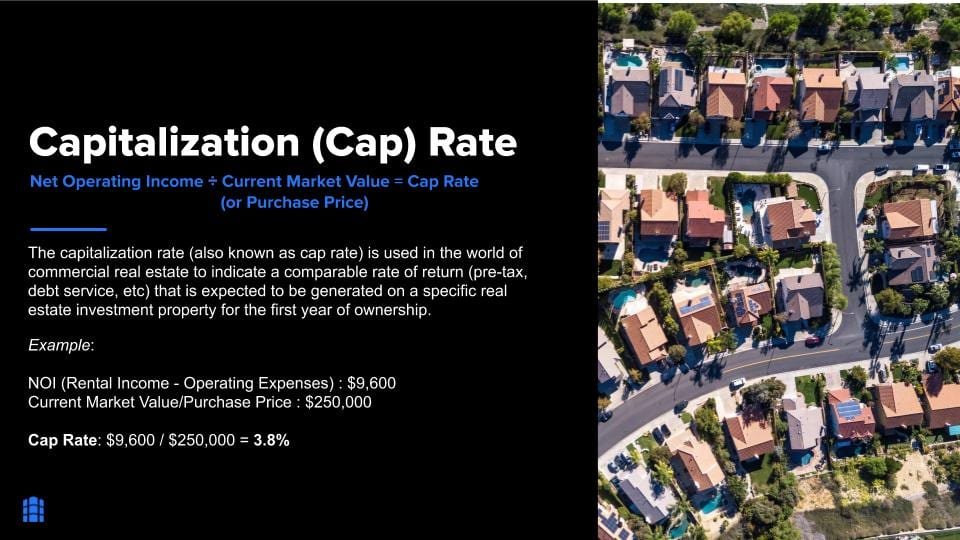

Right, right. That all makes sense. Thank you so much for going into a little more detail on that. Next up we have the capitalization rate, which most people know is cap rate. And the basic calculation for this is net operating income, NOI like we discussed earlier, divided by the current market value or the purchase price, depending on where you're at in the transaction, that equals the cap rate. It is used in the world of commercial real estate to indicate a comparable rate of returns, pre tax, debt service, et cetera, that is expected to be generated on a specific real estate investment property for the first year of ownership. So an example is our previous example, before we had the NOI of $9,600, if the current market value or the purchase price is $250,000, that gives us a cap rate of 3.8%. Now, Louis, I know you've got a lot of information on cap rate so do you want to share with us on this one, please?

Louis Gouletas:

Yeah. So this is one of the cornerstones of real estate financial metrics. You've probably heard of it if you've even considered investing in a real estate property, most of the realtors and real estate agents out there will also know it again, it's popular probably because it's so simple and so streamlined and ubiquitous. So the idea is that we're adding valuation, the market value or purchase price of the property. So what are you going to pay for this property right, compared to the first year only? And I say that specifically, because we can already see the flaw first year only net operating income. Okay. So the ratio between, how much am I paying of the market value versus the net operating income. Now, an issue with this we can see right off the bat. Is that one it's the first year only, so if you hold it for more, this is probably not the best calculation for you.

Louis Gouletas:

In addition to that, it doesn't consider financing. So the financing is sort of held constant or not considered at all really. And what this allows you to do though, is again, compare properties very quickly. So if I see that the rent is going to be a certain amount per month, I can times that by 12 say divided by 50% of the expenses eating up into that revenue that I'm receiving to get to a pretty quick net operating income, then I can take whatever I'm going to pay for this property, or think I'm going to be able to purchase it for, to get to a cap rate. And then I can compare that to a different property. So if I have $1,200 rent, you know, times, 12 months, and there's a 50% expense ratio on $150,000 home, single family rental, I would have a 4.8 Cap rate.

Louis Gouletas:

But if I saw a higher rent on a property, that sounds good, right? More rent, more NOI, most likely. So let's say I have $2,100 rent on a $350,000 home. Well, is that better or worse? Well, the cap rate on that one would be 3.6. So in other words, yes, we have a higher rent for the $350K home, but we have to put in more money to buy those revenue streams that cashflow otherwise known as the rent. So it allows us to go and look at specific properties to not only just say, Hey, there's higher rent here, but what is that a specific mathematical comparison, the ratio versus what is it going to take to purchase this, right? It's calculated on almost every property you're still going to see it, but it should be just one more tool in your toolbox as you're trying to evaluate different properties that might be out there. And as we continue through this, what we're going to need to see is what happens not only on the NOI for the first year, if it goes up or down, we're sort of holding that constant. We don't know what's going to happen in 12 months, but what might also happen in two or five or 10 years from now, it becomes much more difficult than we need to spend a lot more time in our calculations to try and at least have an understanding with something like net present value to help us look at multiple years.

Kat Thigpen:

Sorry about that. I rushed ahead on accident, but that kind of leads us right into where we need to go, I guess, but real quick question on the cap rate, just to clarify to our audience, it's not supposed to be used as a measure of return, correct?

Louis Gouletas:

That is often correct. So you might actually have a cap rate on a property that is a bit lower than some other property, but it turns out the lower cap rate property might be better in the long term when we get to these calculations that take into consideration all of the work you're going to do to improve the property, get higher rents, reduce or maintain the expenses over time. You know, that might be a much better total ROI at the end of the day than a cap rate that is higher because the longer you hold it, the less valuable the cap rate is going to be because that was just the first year. So if it was 20 years from now, it can be a completely different market and the building could be in a very different shape than it is now, especially if you didn't upgrade the roof or keep up with repairs, things like that.

Kat Thigpen:

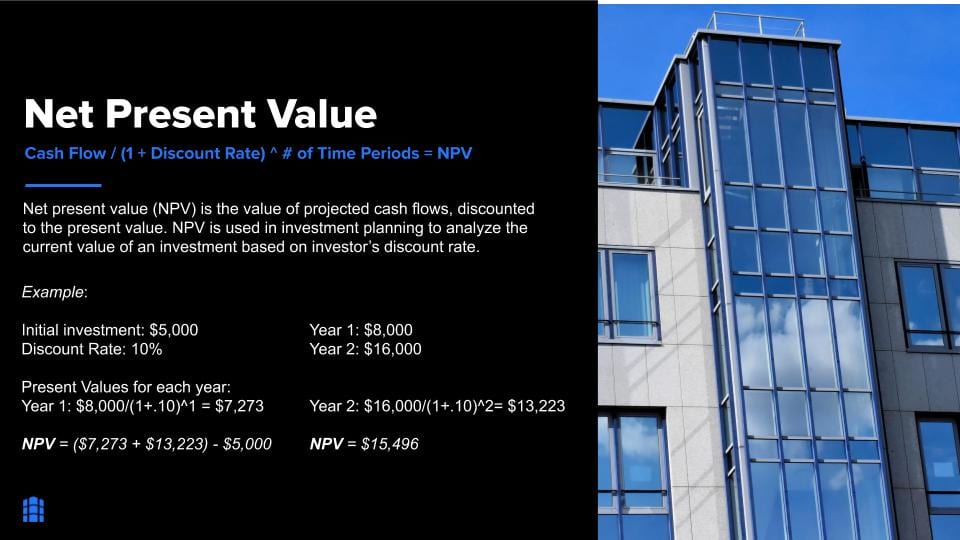

Awesome. Thank you so much for that clarification. I know that's a question I hear a lot, so that's very much appreciated. All right. So let's go back into net present value as you were actually leading into. So net present value and the basic calculation is its cashflow of the property divided by one plus the discount rate to the number time periods. So net present value, basically it's the value of productive cash flows discounted to the present value. NPV is used in investment planning to analyze the current value of an investment based on an investor's discount rate. And I'm sure you'll jump into this a little bit further, Louie, but I'm going to give a quick example, an initial investment of $5,000. And let's say your first year you had a cashflow of $8,000, the second year of $16,000 and your discount rate is 10%. So with the calculation I mentioned before, your net present value actually comes out to $15,496. Now I think you'll jump into this, but the discount rate, where does that number come from? If you don't mind talking about that? And then I know you'll have more to say about NPV.

Louis Gouletas:

Yeah. So to start off, what this starts to get at is the, the all encompassing theory in finance, which is the time value of money, right? So money I have today in my pocket right now is generally always going to be perceived as more valuable to me than some future reward or return cash that I get later. Right? And so in order for investors to part, with their hard earned money, they need to be compensated by some form of paid interest, to give someone a loan, you want interest back or some type of cash flows like we're doing here. Again, we need to consider rental properties as buying cashflow streams, not just the physical asset, or we might look at capital gains that we get from some hot tech stock, you know, increasing multiple folds over the next couple of years that we hold it. Okay. But there's some type of reward that the investor needs to be compensated for to part ways with those hard earned dollars. That here is our discount rate.

Louis Gouletas:

And generally how that's seen is, well, I believe that I can make 6 or 7% of the stock market or maybe 10% in the stock market. In addition to that, sometimes I might consider inflation. And that is the great motivator often of why people want to invest besides for FOMO, fear of missing out. It's not just for teenagers. It's a real thing for investors. If you know, your friend has made a bunch of money from Tesla stock going up, you're going to wish that you had bought that Tesla stock, right? And so you want your money to be active, one cause the markets are always continuing to progress and hopefully usually go up. But, two, inflation generally makes the money you have right now, less valuable. Now inflation lately, we are almost looking at D inflation with the current pandemic that we're in, but with all this money that we've spent, $7 trillion and counting in such a short amount of time, that national deficit grows, the general idea is that there will be inflation and one of best hedges or protections against it potentially is real estate. Now we'll see, there's this idea of new monetary theory that says that as long as we keep inflation low, we can keep printing as much money as we want, but many central banks around the world might argue something different with that. So the whole point is that inflation might be needed to be added on top of the seven or 8% I get from the stock market. So let's say 8% plus 2% for inflation. I need a discount rate of at least 10% to see what the value of those future time periods that I'm going to hold this property for that money tomorrow equals to the money of me having it today. So this is a very simple example of just two years, we've gone beyond the NOI, just one year that cash on cash and cap rate saw to two years based on the 10% that I think I'm going to get from the stock market plus inflation. What is the value of these cash flows two years from now today? And so when we look at the net present values here that are calculated, we can go ahead and see that it's positive, which means I can compare this net present value, positive amount I'm receiving versus a positive or negative net present value I have from some other investment. So now we're starting to be taking in the full encompassing idea that the investor needs to be discounted for the risks that they're taking so that we can mathematically calculate what benefit monetarily are we getting from this versus some other investment that we see. Now we can use this and other calculations and is the core of the next thing we're going to talk about, which is the internal rate of return, the IRR, which is another metric that we need to look at. So it's really one of the calculations that's used in other calculations, you can see all, this is all building as NOI was used as well, but we also need to take this with a grain of salt and know that, yes, this is a bit more complicated, but there's even more to consider such as are we calculating this pretax or post-tax? Are we calculating this on the possible tax benefits that are coming at the sales point where we might have a 1031 exchange or opportunity zones? So even though it's becoming more advanced, there's even more things that we might want to consider to get to a full picture or maybe eventually one day a true ROI.

Kat Thigpen:

Yes. That's a lot of great information again. I actually don't really have anything to add. I think you were really thorough, but why don't we talk a little bit about that. Internal rate of return is the return that equates the present value of the expected future cash flows to the initial capital invested. So where your NPV is zero. So why don't you jump in here, Louie, and tell us a little bit more about this.

Louis Gouletas:

Yeah. So, you know, first off, if you're confused or thrown off by these fancy formulas and things like that, I think our goal here is to build some intuition. For someone looking at a real estate investment, what do these metrics mean? Cause it's very likely you'll, you'll see them certainly NOI, cash on cash, cap rate and then if you want to take it a step further, you want a fundamental understanding of what this is. So don't worry about the fancy formulas. I deal with a lot of this in data science, you know, you're getting down to what does this mean? Which is if I were to calculate all the cash flows and then the last year, including the proceeds from the sales versus what I put into it, we saw a positive net present value in the last calculation but as I hinted to it might've been negative, right? If the NOI continued to decline, if rents went down or expenses went up or the market doesn't see your property as valuable as it was when you first purchased it. In Chicago, we have negative 1% or possibly 2% this year for property values, depending on what ends up happening here.

Louis Gouletas:

Also very dependent on what area that you're in, opposed to Huntsville you're looking at 9% valuation year over year growth at the moment. So there's a lot of calculations that go into this. The point is that the net present value we're no longer worrying about is it positive or is it negative and by how much? Instead we're forcing it to be zero mathematically so that we can get a rate, that's generally a rate of return, that can be compared from property to property. Again, that's really what we're trying to do with a lot of these metrics is get to comparing apples to apples, certainly across properties. So now if one property has an 18% IRR, as we see here, we can generally state that providing that we calculated the NOI correctly for each of the properties and all the other things that went into this and our assumptions of what we can sell it for later, then a 16% IRR property would be less attractive than an 18% IRR. Now this is a much more in depth formula and gives us greater confidence to say that the higher number is better. Unlike the cap rate where a cap rate might be lower on one property or higher, and we might see a totally different IRR where one is, you know, twice the IRR depending on how you're able to improve it and increase rents or expenses.

Okay. So the whole point of this is we're no longer worrying about monetary dollar amounts with NPV. We are using a specific number that everyone agrees on mathematically and in commercial estate, that's why IRR is used so much, is that there's no question on how it's calculated. It is a very simple formula in Excel. You punch in IRR, the negative amount you put in, the cashflows you get out plus the proceed on the last year you're done, right? This is a very basic formula that anyone can use and there's no argument of how it's calculated. Doesn't mean it's not flawed as we're going to continue here, but you're going to see this in such financial software as Argus, or you're going to use it in many of your proformas on multifamily or books that are prepared. You're going to see an IRR. You always need to check the assumptions that go into it, but it's also a great one to use for sensitivity analysis, which means what happens if I don't make those capital improvements, what will the NOI be then? Maybe it doesn't go up as much for the as is versus the alternative of investing more and trying to raise those rents or having lower expenses by improving the, you know, 50 year old boiler that's in the building or something like that, right? So we can use it to compare those two things because it's always calculated the same way and there's no question about how it's calculated.

However, there is a problem with IRR and that problem is that it assumes that the money you get out of each year, the proceeds before or after taxes, but those numbers for those NOI's that you're getting each year, per year after taxes, those are going to be reinvested or assumed to be reinvested at the same rate of return as the rest of this investment. And that ends up inflating this number. And the example I give is, let's say you're getting this $18,000 a year from this property. Well, the IRR assumes you're going to make 18% on that $18,000 you got from year one for the four other years, you're holding it for, for the five year period. I don't know what phone number that is that can guarantee 18% return, but I will be calling it all day, including every other investor that's out there. Right?

Louis Gouletas:

So that is not a reasonable assumption. Okay. But mathematically, it takes care of this issue of different investors, having different discount rates and trying to compare the properties mathematically with more advanced calculations beyond the first year NOI and now, including not just the money I had to put into the property, but the money I get from sales proceeds. So it's a much more holistic picture through the life cycle of an investment property. And it's very good for that sensitivity analysis of changing those things like with my NOI increases, like I was mentioning before. So you will see it all day long in something like Argus. In fact, you could get some other metrics out of it, but all the sensitivity analysis will always come back to IRR. The problem I see is when people assume the IRR is going to be my true hindsight, looking back at it later ROI, when I truly calculate what I put in, what did I get out? This is going to be much higher, most likely than that number because of this reinvestment issue of putting each year's cashflows out, back into the property at this self-inflating rate.

Kat Thigpen:

Right. Well, it definitely sounds more holistic than anything else we've discussed previously. And I know we have another calculation coming up that definitely incorporates what that flaw you were talking about, but the good news is for everybody out there, if you don't want to do this fun little formula that we have, you can do it on any financial calculator. Like Louis said, you can actually put it in Excel. There's already a formula ready to go. So very simple to do, just make sure you have the right data to put in.

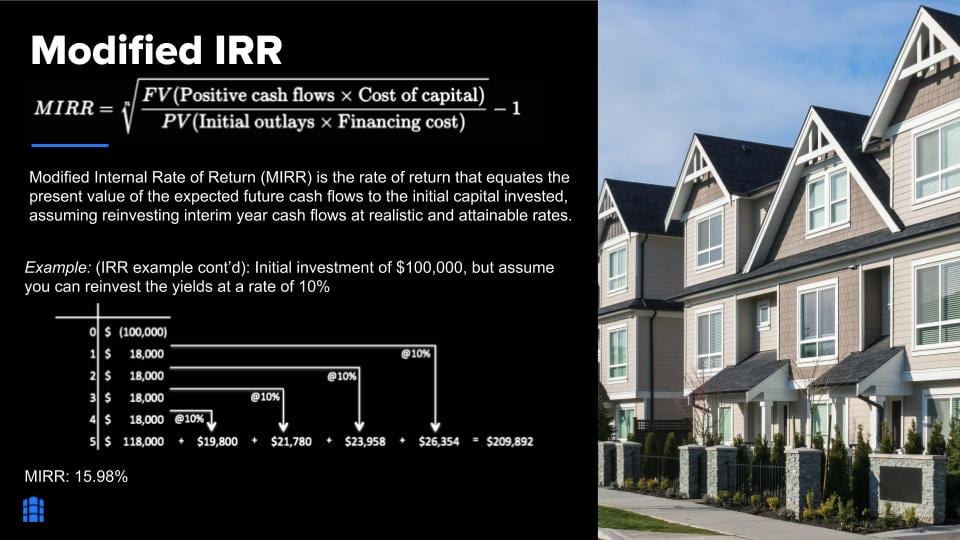

Kat Thigpen:

All right. So we've got Modified Internal Rate of Return, and that is the rate of return that equates the present value of the expected future cash flows to the initial capital invested, assuming the re-investing interim, your cash flows at realistic and attainable rates. So basically you're taking this money that came out each year that you made every year and putting it back into the property. Is that correct, Louis? Am I understanding that right?

Louis Gouletas:

Yeah. So as the name implies, it's the modified part is for the reinvestment rate. So the IRR, we couldn't control what that reinvestment rate is, but here we can. So in this example, it's a bit high at 10%. That'd be great if we could get that 10% each year on that $18,000 that came out for that first year, we'd get that every single year going in for the four remaining years and the same would happen on year two for three years. And so on the point is we can at least go ahead and put in our assumptions of what we think this cashflow is going to do. So maybe it's 2% you put in for a money market account that you're transferring the rents to, or it might be zero in what I call an MIRR zeroed, which is going to be adjusted as consistent as an IRR while removing that self inflation aspect of the IRR.

Louis Gouletas:

And zero is often how I see many small investors consider this. They get their proceeds from the rent after expenses each month, and they're doing whatever they want with that. They might be putting that into the stock market or CDs, or, you know, they're using it to go shopping. Those stocks, their returns, or the negative that comes from shopping, or maybe the positive utility that comes out of it has nothing to do with the real estate investment. Right? So once the money's out, unless you have an asset manager that is specifically putting the cashflows into CDs or a money market account, or some other type of very specific and controlled type of re-investment strategy, generally a lot of people sort of take the money and run. And that's kind of the point. These are cashflow properties, they're income properties to generate income for you much like a bond bite or a dividend coming from stocks. So it's lot of similarities going back and forth between those two. So the modified internal rate of return allows us to add an M in front of the IRR in Excel. And then you're going to add after your range of different cash flows, you're going to add zero comma zero. And what that means is you all have an investment rate of zero if you want this MIRR zeroed on this consistent basis, very similar to the IRR. The other thing that's really nice is sometimes with the IRR, the math gets a little wonky. If you're doing multiple negative years, it really just wants the first year to be negative. But there are some cases where let's say you buy a rundown eight flat multifamily rental investment property, and you weren't able to raise enough money to do all the capital improvements right now or you want to take your time and as tenants move out, you want to upgrade, you might have two years where you're doing four of the units. And then four of the units the second year. That's actually comes close to zero or a negative cash flow and modified internal rate of return is going to be able to handle multiple negative years better than the IRR. So that's another thing to watch out for as you're going through this process. So I really like the MIRR zeroed because it's almost just as easy to do in Excel as IRR, but we get this additional benefit of taking care of the reinvestment issue by zeroing it out and then also getting a bit more accurate with multiple year negative. Such as maybe on year four, you have to do a huge roof replacement to get ready for someone else to purchase it because you want to demand higher price when you go to sell it because you took care of the roof, which was going to cause more damage for you anyway, but you were able to set up reserves through your operating expense budgets each year to be able to pay for that so that it didn't fully hit that so it gives us some more flexibility with this calculation.

Kat Thigpen:

Awesome. Thank you so much. So is this used as often as regular IRR or would you say more people use it or less?

Louis Gouletas:

Unfortunately it is not. I'm probably the only one you've heard actually talk about an MIRR zeroed. Certainly people have, have used MIRR, but the problem is you are now bringing in ambiguity into how the calculation is done, right? Similar to the net present value. We need to know the discount rate of that individual investor. So if we don't know that individual investors or even that investment, the expected reinvestment rate is going to be a totally different calculation than someone else doing it. Right. And that's why like MIRR zeroed, I, I hope it'll catch on, but that's why IRR is still King in commercial real estate, because there's no question of how it's calculated and you can compare properties on many other factors opposed to how did the internal rate of return go through with the calculations?

Kat Thigpen:

Great. Yeah. I definitely have not heard a lot of people using it, but it sounds like it is a better formula and it does include more factors than the IRR does. So thank you for sharing that and Hey, it might catch on. You never know. All right. So I think we have one more and that is compound annual growth rate. Also something, a lot of people might not have heard of not in residential real estate anyway, but just to break down this formula, it is the rate of return that's required for an investment to grow from its beginning balance to its ending balance. So often assuming the after tax total property capital accumulations during the expected ownership period, basically that's the ending value divided by the beginning value to one over the number of years, minus one is also known as CAGR. You want to go to this forest, Louie?

Louis Gouletas:

Yeah. So this calculation comes from finance and you might see it in a finance course, things like that. So it's a very basic formula to a large extent that's trying to poke at a true ROI, return on your investment, because that's what you're trying to get at. The problem is, is what are the inputs? This is where we can do all the homework and create what's generally called a proforma, which is essentially a property investment plan. These are our assumptions each year of what we think the expenses are going to be, and the income's going to be, and how much it's going to go to reserve or how much we're going to apply our capital improvements each year and what we think will increase in rent and how does that affect NOI each year? We'll also look at what we purchased it for and the incoming cap rate, which is what we purchased for the NOI of that first year divided by what we purchased it for.

Louis Gouletas:

And then we'll look at the exit cap rate, which is really what is the market going for? What is the market valuing our cashflows at? Because it's the NOI over the, in that case, the sales price, the market value. And generally what you see in multifamily is that the market cap rate will dictate what someone's going to pay you for that specific cashflow, which is very similar to bonds when you're buying some type of dividend stream also from dividend stocks, you know that, okay, it's giving out this amount during these periods of times on a consistent basis, or has been forecasted or shown a trend of doing so. Then there's the price you pay for that. And you can take a look at, you know, what is that yield that you're getting for that money. It's similar with what is the take home cashflow that income property generating versus what I'm purchasing?

Louis Gouletas:

So that's on the outgoing when you go to sell this in five years. So we can go ahead and calculate what we think the sales proceeds will be when we are able to look at our final year NOI versus what we think the cap rate's going to be to then sort of reverse engineer from the cap rate formula, what our sales prices then going to be at the end of all this right, that someone else is going to purchase this for. Now, the other thing to keep in mind is generally properties are seen as less valuable later as new properties come online, as well as the wear and tear. And if you're doing a value-add someone is going to demand to be compensated for that risk of fixing up that property opposed to a brand new, beautiful, grade A building that was just built is going to fetch a higher price, which generally means a lower cap rate for the same NOI as this C class property that you're trying to do a value add, to say a B class property, something like that.

Louis Gouletas:

That's going to have more risk and someone's going to pay you less for that for say the same amount of cashflow, the NOIs. And so that's where we can see some of these differences come in. The point of all that being, we're trying to get to the ending value, and that's very difficult. So between trying to understand what our exit cap rate's going to be versus the starting cap rate, which is easier to calculate because we have an idea what we're going to purchase the property for. Then we have to look at all the NOIs and what we're going to do to hopefully increase those NOIs over time in our proforma, we can finally get to what our ending value was versus the beginning value. And what we need to also consider in here is the total amounts that we got from all the years that we were having the income come out of this property, hopefully as a positive cashflow property, we can also take into consideration the after tax amounts.

Louis Gouletas:

So we can look at what is my take home after taxes. And everything's done with all the expenses, how much capital have I accumulated over the last five years? So we can see here in this example that instead of being $18,000 per year, we said it was $10,800 over the five years, and we've accumulated $54,000 in capital accumulation after taxes. And then we can look at the after tax proceeds say that was $118,000. We combine those two together. We can then finally take the, say $172k that we ended up with divided by the $100,000 initial investment that we put in over the five years to get this type of almost hopefully true ROI rate. Even then, after we've gone through all this, we don't know that that's truly going to be the return on your investment because that's all in the future and we don't have perfect crystal ball, but we're doing these very precise calculations of what we think the NOI is going to do each year and what the market might be in the future to have a better idea of what we might make.

Louis Gouletas:

And so we see the IRR was 18%. The MIRR was 16%, and then this CAGR all of a sudden dropped it on down to below 12%. And so that's another reason I think that IRR is used a lot in the industry, is that it's always great for the salesperson to show you this higher number, right? And this is not a number that we're arguing with, how it was calculated and what your discount rate was or reinvestment rate was, or did you zero it out? So the combination of those two it's pervasive throughout commercial real estate. However, if you have a CFA, a CCIM, you might ask them to calculate my after tax capital accumulation, compounding annual growth rate, your CAGR to have probably the best idea of what your true ROI is going to be. And that takes into consideration all the financing and the loans and the different things you might be doing with refinancing.

Louis Gouletas:

This can get very complicated there's software out there to do this there's spreadsheets. But at the end of the day, the whole point is, you know, brass tax after it gets through my CPA, and you should have a real estate focused CPA to help you understand these things, because you might be doing things like a 1031 exchange where you're deferring the capital gains. And so therefore your ending value might be higher because he didn't have to pay the government as much. You also have to consider some of your other tax liability because rent is income tax. So that could be the higher tax income brackets versus holding this property long term, you might have some of that. And then there's economic opportunities zones that also can help defer some of those capital gains. So the whole point is you take all of that, the tax considerations, the financing considerations, your investment plan, deployment of capital to improve the property, to maintain a lower the expenses, or to increase the rents over time to get to brass tax. This is how much I'm putting in. This is how long I'm holding it. This is the true amount they get out and getting to what I think I'm actually going to make versus say the stock, because I can also do this for a stock or a bond. I can do the same thing before or after taxes of what I think I'm putting in versus getting out how long I anticipate a hold.

Louis Gouletas:

While, keeping it simple, this formula can be done by financial calculator and Excel, and is very consistent. There's not a lot of argument of how it works. It really comes down to how are you calculating it? Is it with financing, without financing, after taxes, before taxes? And then what we often do is we compare all that. We will compare what the CAGR looks like if we finance versus not finance. Before taxes and after taxes. And we'll look at if we improve it or we don't improve it. And then we look at each property for each of those things while this isn't to scare you with complexity, but it's to create this intuition of continue to ask, continue to dig, continue to do your research and your due diligence of what am I going to make out of this particular investment property versus some other investment property compared to my overall investing goals that I already have with stocks and bonds.

Louis Gouletas:

And should I go through the, you know, risk and hard work that it takes in real estate investing opposed to just continuing to put it in the stock market. Usually you're doing this to have some type of diversification play, to be able to have a direct ownership in property, which can have a lot of additional benefits like financing and different scatter site portfolios. Buy 10 properties, I can sell this one that's underperforming to go into this other one that I wanted to add to the portfolio. When you just buy a REIT or you buy an ETF and a stock, you don't have control over the company's management or what the REIT is purchasing or how they're going about it. With a direct real estate investment that you own, you have all those abilities and additional tax benefits because you directly own that property and, hopefully, these metrics will help to at the very least build some intuition about some of the things you should be looking at when evaluating these types of rental properties.

Kat Thigpen:

That's a lot of great information. So as far as CAGR goes, I know it's not a formula. A lot of people use or even talk about who typically uses this calculation?

Louis Gouletas:

Generally financial advisors. They might talk about it with their clients and you certainly see it if you're a CCIM or a CFA. If someone is producing full performance for you, they might bring this up especially if there are specific tax considerations, such as you have a more complicated portfolio, you own multiple properties and you're considering of doing multiple 1031 exchanges, or you're going in and out of economic opportunity zones. This can sometimes help simplify things because you can go, give me the true raw numbers of what am I taking home if you've talked to your CPA. And then you can really start to look at well, am I going to continue to buy more real estate? Or should I transfer this to some type of a stock or ETF or something like that?

Kat Thigpen:

Perfect. Yes. That's pretty much what I was thinking too. Like, it's good to see where you're at currently with your current portfolio. Helps you decide where move money here or there and what's performing well and what isn't. Thank you so much for explaining that, Louie. That's a really good calculation to know. Do you have any final thoughts? I mean, any calculations you personally prefer to use over the others?

Louis Gouletas:

So I use them all because many people like to see cash on cash. Certainly I'm providing cap rates. Certainly I'm providing an IRR. I generally throw in an MIRR zeroed. And a lot of times I'll go to the effort of calculating CAGR, especially when we're considering options so it's good to know all of them. My suggestion for those that are looking into this is talk to a professional. Your real estate agent might know some of this, but if you have a well inclined asset manager, property manager, certainly a financial advisor, they should be able to help you with some of these basic calculations. And then of course, we'd love to help you with them. We do this quite a bit at NRS and have a great staff that understand all these metrics and put these different things together because our goal is to help real estate investors meet their financial success. And the only way we're able to do that is if we have an investment plan through good proforma and are constantly trying to increase the NOI and therefore the potential value of the property, while thinking strategically of is this the property you should even be holding right now, or should you be considering some of these other properties and trying to look at some of the opportunities that are out there such as Huntsville, Alabama, or Orlando or different markets or different property types. Is it better to own this four flat that is just costing you so much money or two duplexes or four single family homes that we're gonna have more flexibility and what are the pros and cons? So we love discussing those different options that are years of, you know, real estate financial experience, and trying to help our investors reach that end goal that can be complicated with all these metrics, but we try to simplify them, or at least as we're doing here, explain them as best we can so they can make the most important decisions.

Kat Thigpen:

Great. Thank you so much for sharing all of your amazing knowledge with us. If anyone has any other questions or would like to discuss this further, please visit us at www.NRSrentals.com and again, thank you, Louie. I hope you have a wonderful rest of your day and thank you to all who watched, and we will talk to you soon.

Louis Gouletas:

Thank you, Kat. Really appreciate it.”

Are all of these calculations familiar to you? Do you see the benefits of one vs another that you hadn’t thought of previously? Let us know in the comments below!

Interested in starting your real estate investing journey?